Scottish Stamp Duty (LBTT)

One of the key differences between the Scottish property market and that of England and Wales is the Land and Buildings Transaction Tax (LBTT).

This is the tax that is levied on commercial and residential property transactions and is the equivalent of the Stamp Duty Land Tax (SDLT).

Who does LBTT affect?

LBTT will affect all house buyers whether they are ordinary buyers or so-called ‘non-natural persons’, in other words companies and other organisations.

It will affect transactions of both residential and commercial property and in general, it should only apply to a purchase however there are some leases that could be caught by the rules.

How much is LBTT?

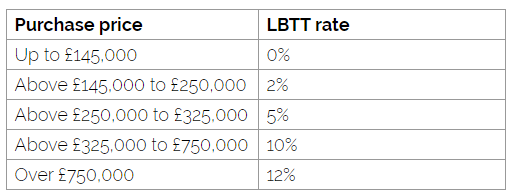

There are a series of different rates of LBTT depending upon the value of the purchase and the type of property bought.

The good news is that if you are buying a house up to £145,000 (which will be the majority of transactions) then the rate levied is 0%, although you should read the section on ADS below.

This moves up on a sliding scale to the top rate of 12% for property that is over £750,000 contract price.

Residential LBTT rates

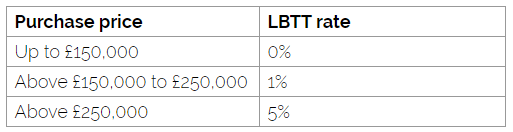

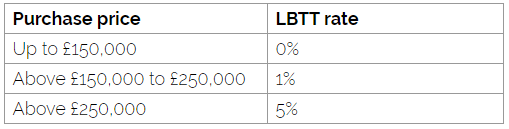

LBTT rates on commercial property

For non-residential property, the rates are slightly different and there are only three bands with the lower band again being 0% and the top band of LBTT reaching 5%

How does LBTT work?

LBTT works differently to Stamp Duty Land Tax in the rest of the UK.

Where SDLT has one rate that is levied on the whole transaction and the rate that applies is based on the total value, LBTT works on a graduated basis.

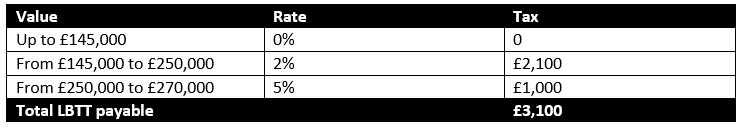

Examples of LBTT

Let’s imagine a house that costs £270,000.

The LBTT will be worked as follows;

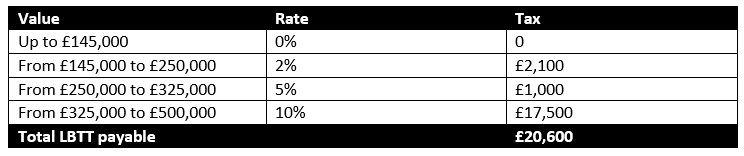

Now we’ll use a house costing £500,000

If you’d like to work out your own LBTT before buying a property then there’s a handy calculator here

Additional Dwelling Supplement

The Additional Dwelling Supplement (ADS) was introduced to help first-time buyers get onto the market.

It applies to all properties that are second or subsequent properties and where the price is £40,000 or over.

For properties that breach the £40,000 limit, an additional 4% of LBTT is levied on the total price.

LBTT on commercial leases

The tax is also charged on commercial property leases.

The system works in a similar way however there are two rate tables that apply and they act differently.

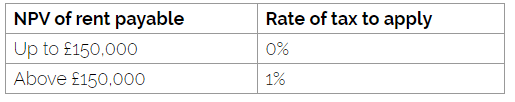

The first relates to the lease itself and is charged according to the net present value (NPV) of the total payments due under the lease.

This works exactly the same way as residential LBTT in that the first £150,000 is disregarded.

The second table comes into effect if there are any additional items paid for as a result of the lease.

Typically, this would be for things like a premium or shop fittings that were included in the sale.

Again, there is a zero-rate band which is designed to help smaller businesses and applies to the first £150,000 of the lease but the crucial difference is that this is levied on the whole transaction.

Lease rental LBTT

LBTT for considerations other than a lease.

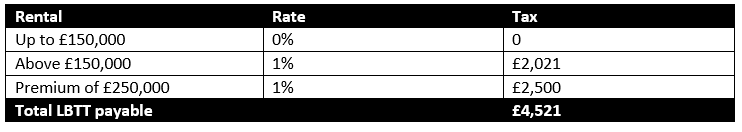

Worked example of LBTT for Leases

In our example, we have taken a lease that has rent payable of £78,000 per year for 5 years and an ingoing premium of £250,000.

This will give us an NPV of £352,174.09 for the rental and the LBTT is worked out in this way

Again, if you would like to work out your own LBTT then Revenue Scotland has a handy calculator for LBTT on commercial leases here

The Land and Buildings Transaction Tax is a self- assessed tax which means that the taxpayer must work out what they owe and then report this to Revenue Scotland. Bear in mind though that there are penalties and interest levied if you do not pay within the time limit however your solicitor should handle all of this for you.