If you rent out a property or are thinking about becoming a landlord you may be wondering what types of expenditure are allowable against your tax bill.

In this post we’d like to run you through a few of the rules.

How taxation works for landlords

The very first thing we have to say is that this is a general guide. You must take qualified advice based on your personal situation.

If you are a private landlord, that is to say you own the houses in your personal name and not through a company, then you will pay tax through the self-assessment system in the UK.

If you are not sure about the difference between a corporate and private landlord then you can find out more here.

As a private landlord you’ll pay tax on the net income from your property and if you have another job then this could be at your highest rate of tax.

At the end of the year you’ll need to fill in a tax self-assessment return and pay any tax due however there are some things you can do to reduce this.

How to reduce your tax bill as a landlord

Imagine you have a house and the rental income is £500 per month or £6,000 per year.

You’ll pay tax on this rental and, assuming that you pay 20% this will be £1,200.

However, you are allowed to offset some genuine costs of running your rental property against your taxation and this will reduce your tax bill considerably.

At the time of writing (2019) we are also in the transition period which means that you can also offset some of the costs of financing your house such as mortgage interest and we’ve written a separate post about this here

What landlord expenses are allowed?

There is a raft of legitimate expenses that you can claim against your tax bill as a landlord.

There is an overarching rule however that they must be wholly and necessarily incurred as a result of running the property to rent out.

Typical examples of allowable expenses include;

- General maintenance and repair costs

- Cost of services, e.g. cleaners, gardeners, ground rent

- Agency and property management fees

- Water rates, council tax and gas and electricity bills (if paid by you as the landlord)

- Insurance (policies for buildings, contents, etc)

- Accountancy fees

As we said earlier these must be incurred wholly for the purpose of running the property but if part of the cost is for your own use, if perhaps you live in a flat at the property, then you must deduct the proportion that is for you.

You can also deduct the cost of replacing larger domestic appliances such as washing machines, cookers etc.

This used to be called the wear and tear allowance but this has now changed to the ‘replacement of domestic items relief’.

Typically, this will relate to things that are required to make the property habitable or to replace items that are currently in place.

Good examples of these would be;

- Furnishings, e.g. curtains, carpets, etc

- Kitchenware

- Replacement beds, wardrobes etc.

- Replacement carpets

- Replacement crockery or cutlery

- Washing machine, dishwasher, cooker, fridge

There are limits though. You must only claim back the cost of replacing like for like.

If you choose to upgrade or improve then you can only claim the value of a like for like replacement.

For example, if you bought a fridge/freezer for £600 that replaced a fridge that would have cost £400 to replace then you can only claim the £400. You can claim the cost of removing the old unit though.

What landlord expenses are not allowed?

The most important item in this section has to be any financing costs.

The rules are little confusing but in all cases, you can’t claim back the capital cost of paying off your mortgage.

From 2017 onwards you haven’t been able to claim your mortgage interest payments.

You will still get relief on these but at a reduced rate. The changes are being phased in now and you can read our guide to mortgage interest here.

You are also not allowed to claim for any items that are used for your personal enjoyment.

If you improve or enhance the property then you won’t be able to claim back the cost however there are benefits available to you when you come to sell the property and the cost of improvements can be offset against capital gains tax.

Landlord expenses – a worked example

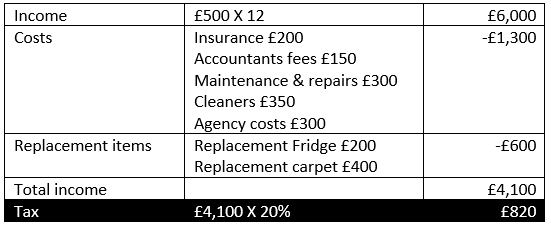

Take a landlord who is a 20% taxpayer and rents out a property he has inherited for £500 per month.

His tax bill at the end of the year will be £1,200 (£500 X 12 =£6,000 X 20% =£1,200).

He wants to reduce this so starts to look at his expenses for the year.

He paid for;

Insurance £200

Accountants fees £150

Maintenance & repairs £300

During the year he had a change of tenant so he also paid for;

Cleaners £350

Replacement Fridge £200

Replacement carpet £400

Agency costs £300

So his total allowable costs for the year are £1,900.

His tax looks like this;

So we can see that our landlord who originally had a tax bill of £1,200 now only has to pay £820.

Naturally, this is a simple example and doesn’t take into account the effect of interest or tax bands so again, we have to repeat that you need to take advice on your own specific situation.

You can find out more about tax at the HMRC website here and if you’d like to speak with us about buying property to let then please drop us a line.