The whole point of investing in property through WTP is to make money and so it is of prime importance that you have the right numbers to back up your plan.

In this article, we’d like to present some typical numbers. Please read these and form your conclusions but we’d also like to point you to our assumptions at the end which tell you how we’ve come to our figures.

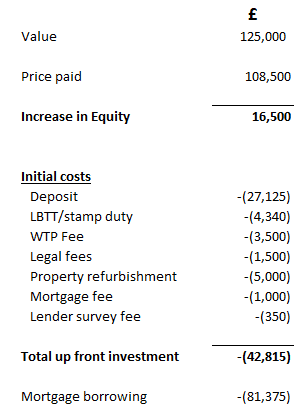

Let’s look firstly at the purchase of the property.

We’ll assume that you have a 25% deposit and want to finance the rest of the house.

A couple of points to note here;

The mortgage fees and legal fees are conservative estimates. We’re always looking around for better and cheaper providers and it may be that we can find you a better deal than this but we wanted to err on the side of caution.

In terms of property refurbishment, it’s unusual that a property won’t need any work at all but it is unlikely to be extensive. We’ve assumed that there will be a bit of decorating, some safety features such as fire alarms and a bathroom or kitchen.

We’ve also assumed that we do a mid-value fit-out. When you are renting out it’s not a great idea to buy top of the line fittings (unless you have a very high-end property) but you need products that will stand up to fair use.

So at this point, you have invested £42,815 and you are employing £124,190 worth of capital, which is the price of the house plus the upfront costs.

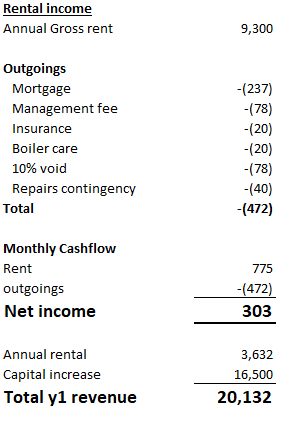

Now let’s look at the rental numbers.

Again, it’s important to note that there are some conservative assumptions here, for example, many clients find they have tenants that are in place for 3 years or more and have no void costs.

So, we can see that we have a pre-tax net monthly income of £303 on average.

Where’s the profit?

The big advantage of buying with Wealth Through Property is that we source properties that are under market value.

In our example, we have achieved a 13.2% instant profit by buying a £125,000 house some £16,500 below the market price.

This is a profit that is locked in right from the start.

Add to this your average rental income from year 1 and you could achieve a return on your £42k initial investment of 47%.

From year 2 onwards you’ll be making in the region of an 8% return which is far in advance of what people are making by putting their cash in the bank.

But of course, the UK property market is increasing every year and using our intelligent purchasing we would look to find properties in areas that are going to outstrip the general UK market.

You can usually expect around a 3% increase across the board in the UK but by investing intelligently this can be increased markedly.

This means that your pre-tax yield could be in the region of 11%.

We think that for an investment that is literally ‘as safe as houses’ this is an excellent return and for most investors, a property portfolio is the way to go.

Assumptions

The example given above is based on a real-life property deal in Midlothian, Scotland.

It’s important to be realistic and we also have to point out that these are numbers from a typical deal but they aren’t guaranteed.

For example, we’ve put in a contingency for repairs at £40 per month. Now it’s unlikely you’ll pay £40 per month every month.

What’s much more likely is that it will cost an average of £40 per month across the life of a tenancy and you’ll probably make repairs at the end of each tenancy.

It’s also important to realise that repairs might be more or less than £40. It’s something we just don’t know but we’ve used values that we see in real life to give you a picture.

We have assumed an industry-standard 1/12th void rate. This is the time the property stands unlet between tenancies.

Again it’s likely that you may have two months void every two or three years rather than one month every year.

How to increase your profit

We’ve been fairly conservative here but there are a few ways you can increase your profit.

The void rate is really up to you. If you push to get refurbishments done quickly and the property re-let then you won’t suffer as long a void rate.

You may choose to manage the property yourself in which case you can increase your monthly rental by £78. You may even have a cheaper insurance deal, especially if you have more than one property.

If you are particularly hands-on you could do the refurbs yourself or with members of your family or friends which will save you money.

Interest rates are really cheap in the UK at the moment and depending upon your credit rating you may be able to strike a better deal.

So you can see there are all sorts of ways in which you can increase your profit and to a large extent they depend upon what type of investor you are.

Some people love to be very hands-on in which case they invest more of their time and make more money.

Others have better things to do with their time and take a reduced yield for a more ‘fire-and-forget’ approach.

Whatever you aims and desires around property investment, talk to Wealth Through Property first.

We can help you source just the right property for your investment needs.

Call us now!