Many private landlords take out mortgages on their rental properties and if this applies to you then you may be wondering whether you can claim back tax on your interest payments.

In 2017 the government brought in a big change to the way that mortgage interest is handled within the tax system and as a result, landlords started to see their tax bills rise.

Prior to the change landlords were entitled to offset any mortgage interest paid on their rental properties against their tax bills however this is no longer the case.

Instead of charging the cost of interest against their rental income, landlords now receive a 20% tax credit against their tax bill.

Now this may seem like an insignificant change but for people who are on the 40% tax band this could add up to a significant amount of money.

Buy to let mortgage interest tax changes explained

Under the new system, landlords are allowed to claim the basic rate of tax value of a qualifying amount.

This is the lower of;

Finance costs (mortgage, loans or overdrafts) – costs not deducted from rental income in the tax year

or

Property business profits – the profits of the property business in the tax year

or

Adjusted total income – your income (after losses and reliefs, and excluding savings and dividends income) that exceeds your personal allowance

In other words, HMRC is saying that you can have a tax credit as long as your finance costs are more or equal to your property business profits and your total personal income.

It’s worth remembering that this is a tax credit so this means that the allowance can’t be used to create a tax repayment situation.

Now we realise that can seem pretty complicated so it is always worth speaking with an accountant who specialises in property taxation.

A worked example of Mortgage interest tax for landlords

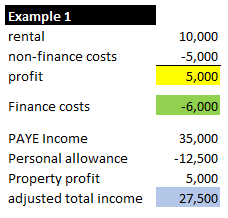

We’ll take an example of a person who has a property that they let out for £10,000. They have a mortgage that costs £6,000 per year and a job that pays £35,000.

In this case we can see that their Adjusted total income (blue) is bigger than their Finance costs (green) which in turn are bigger than their rental business profits (yellow).

Therefore they would receive a tax credit of 20% X £5,000 = £1,000.

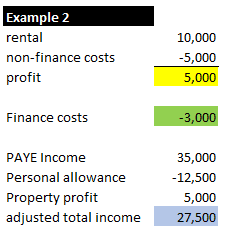

In example 2 our person still has a job and rents the property for the same amount but their finance costs are lower at £3,000.

Consequently, their credit will be based on the finance costs as this is the lowest amount so £3,000 X 20% = £600.

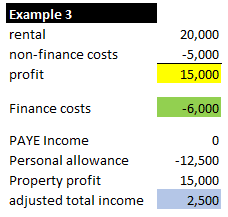

In our final example, our person does not have another job and they rent a property for £20,000 pa.

Their finance costs are £6,000 per year.

In this case we can see that as they don’t have another source of income their adjusted total income is used and this means that their tax credit is calculated as £2,500 X 20%=£500.

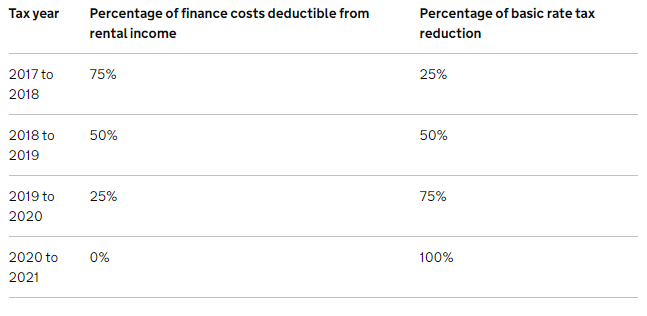

Transitional arrangements. Naturally this was seen as a massive change for the industry and so the government brought in a transitional relief scheme which meant that the effect was spread over three years before the full effect is felt in 2020/2021.

In summary then, the answer to the question ‘can I claim tax back on my mortgage payments?’ is ‘yes’.

It’s less than it was before but for many people it is still a valuable tax credit and is important to claim.

Again we’d suggest speaking with a qualified accountant who will be able to advise you on your own situation.

You can find out more about the tax changes for landlords on the HMRC website here and if you’d like to talk about getting great value property to start your portfolio then contact us here