Guide to UK property for overseas investors

If you are looking for somewhere that is safe and secure for your money, but that will still make excellent capital gains then the UK is the place for you.

The UK market is buoyant and active and with an average of 70,000 transactions per month there is ample opportunity to find a bargain.

The profile of the UK property market

In the UK there are around 29 million dwellings and these are split 70% owner-occupied, 18% social housing and 12% privately rented.

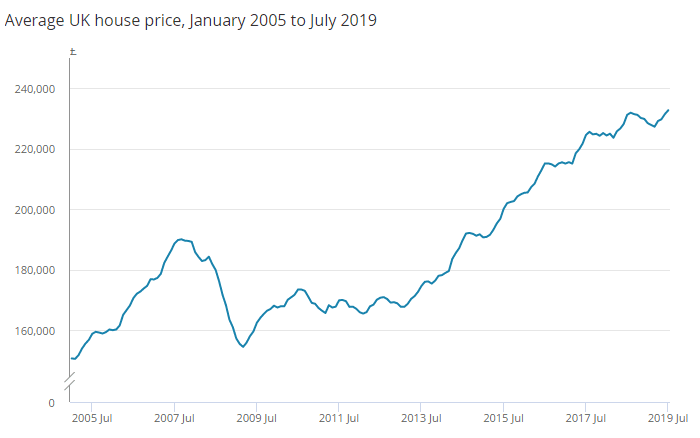

Over the past few decades, the property sector has seen massive growth in prices and in the last 14 years the average house price has increased from £150k to £233k.

For investors who are looking for good capital growth, this means that a buy and hold strategy can work well.

Investors can choose to hold property as a place to visit occasionally or make use of the burgeoning UK rental market to provide an income and growth portfolio.

You can find out more from the UK Office for National Statistics

The rental market

There are a shade under 4 million households in the UK rental sector and for the investor, this presents an excellent opportunity for a good rental yield.

Generally speaking, the rental market tends towards younger householders and the largest group of private renters are in the 25-34 age bracket.

Across the marketplace, there is a lack of suitable properties at all price levels and this widespread reduced availability has been the case for many years.

This means that in the UK, not only have house prices increased but rental income has also risen but by slightly bigger factor than the capital cost.

Can foreigners buy property in the UK?

The simple answer is yes!

There are no legal restrictions on foreigners buying property in the UK.

Properties can be purchased for sale, refurbishment or ongoing rental with no problems.

The UK has tax treaties with most jurisdictions which means that the income will be treated as taxed in your home country but you should always take advice on your individual situation from a suitably qualified advisor.

Properties can be purchased as an individual, as a partnership or through a specific Special Purpose Vehicle (SPV) company which will hold the property as part of its investment portfolio.

Overall a great place to invest

The UK is a well regulated and safe haven for your money.

The light touch in terms of foreign investment means that there are few restrictions on buying property, capital gains and selling and repatriating the money afterwards.

There are some superb bargains to be had, as long as you know the market and with Wealth through property as your partners you won’t go wrong.

So whether you are looking for capital growth, a quick turnaround or a buy and build portfolio then give us a call – we are only too happy to help.